4 | | Board Risk Oversight Our Board of Directors believes that a fundamental part of risk management is understanding the risks that we face, monitoring these risks and adopting appropriate control and mitigation of these risks. As stated in our Corporate Governance Principles, our Board of Directors and its committees are responsible for “reviewing the Company’s risk framework and governance and management’s exercise of its responsibility to assess, monitor and manage the Company’s significant risk exposures.” Our Board of Directors oversees the management of material risks facing the Company. Biogen is committed to fostering a company culture of risk-adjusted decision-making without constraining reasonable risk-taking and innovation. Our Board of Directors and its committees oversee our efforts to foster this culture. Our Board of Directors regularly receives information about our material strategic, operational, financial and compliance risks and management’s response to, and mitigation of, such risks. In addition, our risk management systems, including our risk assessment processes, internal control over financial reporting, compliance programs and internal and external auditing procedures, are designed to inform management and our Board of Directors about our material risks. As part of its risk oversight function, our Board of Directors and its committees review this framework, its operation and our strategies for generating long-term value for our stockholders to ensure that such strategies will not motivate management to take excessive risks. Our Board of Directors also reviews enterprise risks and discusses them with our management, including issues relevant to our business, reputation and strategy, including intellectual property risk, pipeline and business development, pricing and patient access, legal and regulatory matters and manufacturing. In addition, our Board of Directors and its committees oversee elements of our culture. Management updates our C&MD Committee on our compensation practices and progress against strategies and objectives in the areas of management and leadership development and diversity as well as steps taken to address matters such as inappropriate workplace behavior, including harassment and retaliation. In addition, our Audit Committee is responsible for the oversight of our compliance program. Audit Committee Matters | | | | | | | | | 23 | |

| |  |

| | | | 3 | | Board of Directors (continued) |

In determining the allocation of risk oversight responsibilities, our Board of Directors and its committees generally oversee material risks within their identified areas of concern. Our Board of Directors and each of its committees meet regularly with management to ensure that management is exercising its responsibility to identify relevant risks and is adequately assessing, monitoring and taking appropriate action to mitigate risk. In the event a committee receives a report from members of management on areas of material risk to the Company, the Chair of the relevant committee reports on the discussion to the full Board of Directors at the next Board of Directors meeting. This enables our Board of Directors and its committees to coordinate their oversight of risk and identify risk interrelationships. Our independent Chairman of the Board promotes effective communication and consideration of matters presenting significant risks to the Company through his role in developing our Board of Directors’ meeting agendas, advising committee chairs, chairing meetings of the independent directors and facilitating communications between independent directors and our Chief Executive Officer. A summary of the key areas of risk oversight responsibility of our Board of Directors and each of its committees is set forth below: | | | | | | | Board or Committee | | Area of Risk Oversight | Board | | • Corporate and commercial strategy and execution, pricing and reimbursement, competition, reputational, environmental, health and sustainability and other material risks • Research and development activities, clinical development, drug safety and intellectual property • Material government and other investigations and litigation • Risk governance framework and infrastructure designed to identify, assess, manage and monitor the Company’s material risks • Risk management policies, guidelines and practices implemented by Company management | | | Audit | | • Financial, accounting, disclosure, corporate compliance, distributors, insurance, capital, credit, anti-bribery and anti-corruption matters and other risks reviewed in its oversight of the internal audit and corporate compliance functions • Information technology and cybersecurity risks | | | Compensation and Management Development | | • Workforce matters, including harassment • Compensation policies and practices, including whether such policies and practices balance risk-taking and rewards in an appropriate manner as discussed further below | | | Corporate Governance | | • Corporate governance and board succession, director independence, potential conflicts of interest and related party transactions involving directors and executive officers | | |

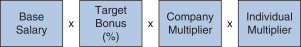

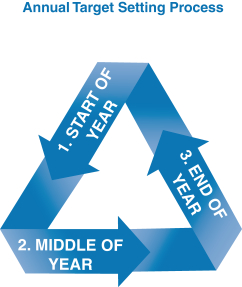

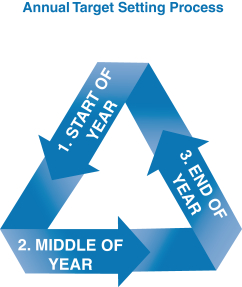

Compensation Risk Assessment The Compensation Discussion and Analysis (CD&A) section of this Proxy Statement describes our compensation policies, programs and practices for our named executive officers. Our goal-setting, performance assessment and compensation decision-making processes described in the CD&A generally apply to all employees. We offer a limited number of short-term cash incentive plans, with employees eligible for either our annual bonus plan or a sales incentive compensation plan. Except in limited circumstances, no employee is eligible to participate in more than one cash incentive plan at any time. Our annual bonus plan is consistently maintained for all participants globally, with the same Company performance goals, payout levels (as a percentage of target) and administrative provisions regardless of the participant’s job level, location or function in the Company. We also have a long-term incentive program that provides different forms of awards depending upon an employee’s level but is otherwise consistent throughout the Company. In the CD&A, we describe the risk-mitigation controls for our executive compensation programs. These controls include C&MD Committee review and approval of the design, goals and payouts under our annual bonus plan and long-term incentive program and each executive officer’s compensation (or, in the case of our Chief Executive Officer’s compensation, a recommendation of that compensation to our Board of Directors for its approval). In addition, we review the processes, controls and design of our sales incentive compensation plans. | | | | | | | | | 24 | |

| |  |

| | | | 3 | | Board of Directors (continued) |

The C&MD Committee, working with its independent compensation consultant, also conducts an annual assessment of potential risks related to our compensation policies, programs and practices. Among other factors, this risk assessment considers the form of compensation (i.e., award type, fixed versus variable and short-term versus long-term), pay alignment, performance measures and goals, payout maximums, vesting periods and C&MD Committee oversight and independence. This assessment is focused on (1) having an appropriate balance in our program structure to mitigate compensation-related risk with cash versus stock, short-term versus long-term measurement and financial versus non-financial goals; and (2) policies and practices to mitigate compensation-related risk including recoupment of compensation, stock ownership guidelines, equity administration rules and insider-trading and hedging prohibitions. Based on our assessment, we believe that, through a combination of risk-mitigating features and incentives guided by relevant market practices and Company-wide goals, our compensation policies, programs and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. | | | | | | | | | 25 | |

| |  |

STOCK OWNERSHIP The following table and accompanying notes provide information about the beneficial ownership of our common stock by: each stockholder known by us to be the beneficial owner of more than 5% of our common stock; each of our named executive officers; each of our directors and nominees for director; and all of our directors and executive officers as a group. Except as otherwise noted, the persons identified have sole voting and investment power with respect to the shares of our common stock beneficially owned. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to the shares. Except as otherwise noted, the information below is as of April 5, 2021 (Ownership Date). Unless otherwise indicated in the footnotes, the address of each of the individuals named below is: c/o Biogen Inc., 225 Binney Street, Cambridge, Massachusetts 02142. | | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Shares

Owned(1) | | Shares Subject to Options and Stock Units(2) | | Total Number of Shares Beneficially Owned(1) | | Percentage of Outstanding Shares(3) | 5% Stockholders | | | | | | | | | | | | | | | | | | | | | PRIMECAP Management Company(4) 177 East Colorado Boulevard 11th Floor Pasadena, CA 91105 | | | | 15,822,066 | | | | | — | | | | | 15,822,066 | | | | | 10.28 | % | BlackRock, Inc.(5) 55 East 52nd Street New York, NY 10055 | | | | 13,419,601 | | | | | — | | | | | 13,419,601 | | | | | 8.7 | % | The Vanguard Group(6) 100 Vanguard Boulevard Malvern, PA 19355 | | | | 11,896,510 | | | | | — | | | | | 11,896,510 | | | | | 7.73 | % | Named Executive Officers | | | | | | | | | | | | | | | | | | | | | Michel Vounatsos | | | | 53,072 | | | | | — | | | | | 53,072 | | | | | * | | Michael R. McDonnell | | | | — | | | | | — | | | | | — | | | | | — | | Alfred W. Sandrock, Jr. | | | | 17,841 | | | | | — | | | | | 17,841 | | | | | * | | Susan H. Alexander | | | | 41,576 | | | | | — | | | | | 41,576 | | | | | * | | Chirfi Guindo | | | | 6,006 | | | | | — | | | | | 6,006 | | | | | * | | Jeffrey D. Capello(7) | | | | 3,118 | | | | | — | | | | | 3,118 | | | | | * | | Directors | | | | | | | | | | | | | | | | | | | | | Alexander J. Denner(8) | | | | 655,064 | | | | | 890 | | | | | 655,954 | | | | | * | | Caroline D. Dorsa | | | | 20,207 | | | | | 890 | | | | | 21,097 | | | | | * | | Maria C. Freire | | | | — | | | | | — | | | | | — | | | | | — | | William A. Hawkins | | | | 1,115 | | | | | 890 | | | | | 2,045 | | | | | * | | William D. Jones | | | | — | | | | | — | | | | | — | | | | | — | | Nancy L. Leaming | | | | 12,098 | | | | | 890 | | | | | 12,988 | | | | | * | | Jesus B. Mantas | | | | 2,053 | | | | | 890 | | | | | 2,943 | | | | | * | | Richard C. Mulligan | | | | 12,064 | | | | | 890 | | | | | 12,954 | | | | | * | | Robert W. Pangia(9) | | | | 19,742 | | | | | 890 | | | | | 20,632 | | | | | * | | Stelios Papadopoulos(10) | | | | 33,301 | | | | | 1,470 | | | | | 34,771 | | | | | * | | Brian S. Posner | | | | 6,870 | | | | | 890 | | | | | 7,760 | | | | | * | | Eric K. Rowinsky | | | | 16,179 | | | | | 890 | | | | | 17,069 | | | | | * | | Stephen A. Sherwin | | | | 15,438 | | | | | 890 | | | | | 16,328 | | | | | * | | Executive officers and directors as a group (21 persons)(11) | | | | 926,695 | | | | | 10,370 | | | | | 937,065 | | | | | * | |

| * | Represents beneficial ownership of less than 1% of our outstanding shares of common stock. |

| | | | | | | | | 26 | |

| |  |

| | | | 4 | | Stock Ownership (continued) |

Audit and Other Fees

| (1) | The following table shows fees for professional audit services billed to us by PwC for the auditshares described as “owned” are shares of our annual consolidated financial statementscommon stock directly or indirectly owned by each listed person, rounded up to the nearest whole share. |

| (2) | Includes RSUs that will vest within 60 days of the Ownership Date. |

| (3) | The calculation of percentages is based upon 150,554,556 shares outstanding on the Ownership Date, plus for each of the years endedindividuals listed above the shares subject to RSUs exercisable within 60 days of the Ownership Date, as reflected in the column under the heading “Shares Subject to Options and Stock Units.” |

| (4) | Based solely on information as of December 31, 2018,2020, contained in a Schedule 13G/A filed with the SEC by PRIMECAP Management Company on February 12, 2021, which also indicates that it has sole voting power over 15,443,182 shares and sole dispositive power over 15,822,066 shares. |

| (5) | Based solely on information as of December 31, 2017, and fees billed to us2020, contained in a Schedule 13G/A filed with the SEC by PwC for other services provided during 2018 and 2017: | | | | | | | | | | | | Fees (amounts in thousands) | | 2018 | | | 2017 | | Audit fees | | $ | 5,177.6 | | | $ | 5,036.3 | | Audit-related fees | | | 302.0 | | | | 281.2 | | Tax fees* | | | 609.0 | | | | 381.0 | | All other fees | | | 322.1 | | | | 7.1 | | Total | | $ | 6,410.7 | | | $ | 5,705.6 | |

* | Includes tax compliance fees of approximately $0.1 million in 2018 and 2017.

|

Audit feesare fees for the audit of our 2018 and 2017 consolidated financial statements included in our Annual ReportsBlackRock, Inc. on Form10-K, reviews of our condensed consolidated financial statements included in our Quarterly Reports on Form10-Q, review of the consolidated financial

statements incorporated by reference into our outstanding registration statements and statutory audit fees in overseas jurisdictions.

Audit-related fees are feesJanuary 29, 2021, which also indicates that principally relate to assurance and related services that are also performed by our independent registered public accounting firm. More specifically, these services include audits of employee benefit plan information, accounting consultations, due diligence and audits in connection with business development activity, internal control reviews and attest services related to financial reporting that are not required by statute or regulation.

Tax feesare fees for tax compliance and planning services. The increase in fees incurred in 2018 is driven by incremental support for international tax matters.

All other feesin 2018 include $0.3 million related to consultation servicesit has sole voting power with respect to supply chain optimization strategies for11,672,922 shares and sole dispositive power with respect to 13,419,601 shares.

|

| (6) | Based solely on information as of December 31, 2020, contained in a Schedule 13G/A filed with the development of new productsSEC by The Vanguard Group on February 10, 2021, which also indicates that it has sole dispositive power with respect to 11,213,323 shares, shared voting power with respect to 259,934 shares and services. All other fees in 2018shared dispositive power with respect to 638,187 shares. |

| (7) | Mr. Capello ceased to be our Executive Vice President and 2017 also includelicense fees for aweb-based accounting research tool. Policy onPre-Approval of Audit andNon-Audit Services

Our Audit Committee has the sole authority to approve the scope of the audit and any audit-related services as well as all audit fees and terms. Our Audit Committee mustpre-approve any audit andnon-audit services provided by our independent registered public accounting firm. Our Audit Committee will not approve the engagement of the independent registered public accounting firm to perform any services that the independent registered public accounting firm would be prohibited from providing under applicable securities laws, Nasdaq requirements or Public Company Accounting Oversight Board rules. In assessing whether to approve the use of our independent registered public accounting firm to provide permittednon-audit services, our Audit Committee tries to minimize relationships that could appear to impair the objectivity of our independent registered public accounting firm. Our Audit Committee will approve permittednon-audit services by our independent registered public accounting firm only when it will be more effective or economical to have such services provided by our independent registered public accounting firm than by another firm.

Our Audit Committee annually reviews andpre-approves the audit, audit-related, tax and other permissiblenon-audit services that can be provided by the independent registered public accounting firm. After the annual review, any proposed services exceedingpre-set levels or amounts, or additional services not previously approved requires separatepre-approval by our Audit Committee or the Chair of our Audit Committee. Anypre-approval decision made by the Chair of our Audit Committee is reported to our Audit Committee at the next regularly scheduled Audit Committee meeting. Our Chief Financial Officer on August 15, 2020, and ourseparated from the Company on September 15, 2020.

|

| (8) | Includes 643,000 shares beneficially owned by funds and accounts managed by Sarissa Capital Management LP, a Delaware limited partnership (Sarissa Capital). Dr. Denner is the Chief AccountingInvestment Officer can approve up to an additional $50,000 inof Sarissa Capital and ultimately controls the aggregate per calendar year for categories of services that our Audit Committee (or the Chair through its delegated authority) haspre-approved. Allfunds and accounts managed by Sarissa Capital. By virtue of the services provided by PwC during 2018 and 2017 wereforegoing, Dr. Denner may be deemed to indirectly beneficially own (as that term is defined in Rule pre-approved13d-3 in accordance with this policy.

| | | | | 29 | |  | |  |

| | | 5 | | Executive Compensation Mattersof the Exchange Act) the 643,000 shares that those entities beneficially own. Dr. Denner disclaims beneficial ownership of these shares except to the extent of any pecuniary interest therein.

|

| (9) | | | | | | | | | | | | | Proposal 3 – Advisory Vote on Executive Compensation

| | | | | | | |

Our Compensation Discussion and Analysis,Includes 16,000 shares beneficially owned by Robin Drive, LLC, of which appears below, describes our executive compensation programs andMr. Pangia’s wife is the compensation decisions that our C&MD Committee andTrustee. Mr. Pangia is retiring from our Board of Directors, made with respect to the 2018 compensation of our named executive officers. As required pursuant to Section 14Aeffective as of the Exchange Act, our BoardAnnual Meeting.

|

| (10) | Includes 28,206 shares held in limited liability companies of Directorswhich Dr. Papadopoulos is asking that stockholders cast anon-binding, advisory vote FOR the following resolution:sole manager. |

| (11) | “RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of RegulationS-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”Includes 688,175 shares held indirectly through trusts, funds, defined benefit plans or limited liability companies.

Our Board of Directors is asking that our stockholders support this proposal. Although the vote you are being asked to cast isnon-binding, we value the views of our stockholders, and our C&MD Committee and our Board of Directors will consider the outcome of the vote when making future compensation decisions for our named executive officers.

|

| | | | | | | | | As we describe in our Compensation Discussion and Analysis, our executive compensation programs embody apay-for-performance philosophy that supports our business strategy and aligns the interests of our executives with those of our stockholders. In particular, our compensation programs reward financial, strategic and operational performance and the goals set under our plans support our short- and long-range plans. In addition, to discourage excessive risk taking, we maintain policies for stock ownership and our equity and annual bonus incentive plans have provisions providing for the recoupment of compensation. We also cap payments under our annual bonus plan and we generally require multi-year vesting periods for long-term incentive awards.27

| | We will hold anon-binding, advisory vote of our stockholders on the compensation of our named executive officers every year until the next required stockholder vote on the frequency of such advisory vote. The next stockholder vote on the frequency of such advisory vote is expected to be held at the 2023 annual meeting of stockholders.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

FOR THE APPROVAL OF THE RESOLUTION SET FORTH ABOVE.

| | | | | 30 | |  | |  |

| | | | | | | Proposal 2 – Ratification of the Selection of Our Independent Registered Public Accounting Firm | | | | | | | |

Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit our consolidated financial statements. Our Audit Committee has selected PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2021. PwC has served as our independent registered public accounting firm since 2003. In order to assure continuing auditor independence, our Audit Committee periodically considers whether there should be a rotation of the independent registered public accounting firm. Further, in conjunction with the rotation of the auditing firm’s lead engagement partner required by applicable SEC rules, our Audit Committee and its Chair has in the past been, and in the future will be, directly involved in the selection of PwC’s new lead engagement partner. Our Audit Committee believes at this time that the continued retention of PwC to serve as our independent registered public accounting firm is in the best interest of Biogen and its stockholders. Although stockholder approval of our Audit Committee’s selection of PwC is not required, our Board of Directors believes that it is a matter of good corporate practice to solicit stockholder ratification of this selection. If our stockholders do not ratify the selection of PwC as our independent registered public accounting firm, our Audit Committee will reconsider its selection. Even if the selection is ratified, our Audit Committee always has the ability to change the engagement of PwC if it considers that a change is in Biogen’s best interest. Representatives of PwC will participate in the Annual Meeting, have the opportunity to make a statement if they so desire and be available to respond to appropriate questions. OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2021. | | | | | | | | | 28 | |

| |  |

| | | | 5 | | Audit Committee Matters (continued) |

Audit Committee Report The Audit Committee’s role is to act on behalf of our Board of Directors in the oversight of Biogen’s financial reporting, internal control and audit functions. The roles and responsibilities of the Audit Committee are set forth in the written charter adopted by our Board of Directors, which is posted on our website, www.biogen.com, under the “Corporate Governance” subsection of the “Investors” section of the website. Management has primary responsibility for the financial statements and the reporting process, including the systems of internal control. In fulfilling its oversight responsibilities, the Audit Committee, among other things: reviewed and discussed with management the audited consolidated financial statements contained in Biogen’s 2020 Annual Report on Form 10-K; discussed with PwC, Biogen’s independent registered public accounting firm, the overall scope and plans for the audit; met with PwC, with and without management present, to discuss the results of its examination, management’s response to any significant findings, its observations of Biogen’s internal control, the overall quality of Biogen’s financial reporting, the selection, application and disclosure of critical accounting policies, new accounting developments and accounting-related disclosures, the key accounting judgments and assumptions made in preparing the financial statements and whether the financial statements would have materially changed had different judgments and assumptions been made and other pertinent items related to Biogen’s accounting, internal control and financial reporting; discussed with representatives of Biogen’s corporate internal audit staff, with and without management present, their purpose, authority, audit plan and reports; reviewed and discussed with PwC the matters required by the Public Company Accounting Oversight Board and the SEC; discussed with PwC its independence from management and Biogen, including the written disclosures and letter concerning independence received from PwC under applicable requirements of the Public Company Accounting Oversight Board. The Audit Committee has determined that the provision of non-audit services to Biogen by PwC is compatible with its independence; provided oversight and advice to management in connection with Biogen’s system of internal control over financial reporting in response to the requirements set forth in Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. In connection with this oversight, the Audit Committee reviewed a report by management on the effectiveness of Biogen’s internal control over financial reporting; and reviewed PwC’s Report of Independent Registered Public Accounting Firm included in Biogen’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, related to its audit of the effectiveness of internal control over financial reporting. In reliance on these reviews and discussions, the Audit Committee recommended to our Board of Directors that the audited consolidated financial statements be included in Biogen’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for filing with the SEC. The Audit Committee of our Board of Directors: Caroline D. Dorsa (Chair) William A. Hawkins Nancy L. Leaming Stephen A. Sherwin, M.D. | | | | | | | | | 29 | |

| |  |

| | | | 5 | | Audit Committee Matters (continued) |

Audit and Other Fees The following table shows fees for professional audit services billed to us by PwC for the audit of our annual consolidated financial statements for the years ended December 31, 2020 and December 31, 2019, and fees billed to us by PwC for other services provided during 2020 and 2019: | | | | | | | | | | | | Fees (amounts in thousands) | | 2020 | | | 2019 | | Audit fees | | $ | 5,882.0 | | | $ | 6,080.3 | | Audit-related fees | | | 48.2 | | | | 55.0 | | Tax fees* | | | 392.5 | | | | 641.8 | | All other fees | | | 9.9 | | | | 7.0 | | Total | | $ | 6,332.6 | | | $ | 6,784.1 | |

| * | Includes tax compliance fees of approximately $0.1 million in 2020 and 2019. |

Audit fees are fees for the audit of our 2020 and 2019 consolidated financial statements included in our Annual Reports on Form 10-K, reviews of our condensed consolidated financial statements included in our Quarterly Reports on Form 10-Q, review of the consolidated financial statements incorporated by reference into our outstanding registration statements and statutory audit fees in overseas jurisdictions. Audit-related fees are fees that principally relate to assurance and related services that are also performed by our independent registered public accounting firm. More specifically, these services include audits of employee benefit plan information, accounting consultations, due diligence and audits in connection with business development activity, internal control reviews and attest services related to financial reporting that are not required by statute or regulation. Tax fees are fees for tax compliance and planning services. All other fees in 2020 and 2019 also includelicense fees for a web-based accounting research tool. Policy on Pre-Approval of Audit and Non-Audit Services Our Audit Committee has the sole authority to approve the scope of the audit and any audit-related services as well as all audit fees and terms. Our Audit Committee must pre-approve any audit and non-audit services provided by our independent registered public accounting firm. Our Audit Committee will not approve the engagement of the independent registered public accounting firm to perform any services that the independent registered public accounting firm would be prohibited from providing under applicable securities laws, Nasdaq requirements or Public Company Accounting Oversight Board rules. In assessing whether to approve the use of our independent registered public accounting firm to provide permitted non-audit services, our Audit Committee tries to minimize relationships that could appear to impair the objectivity of our independent registered public accounting firm. Our Audit Committee will approve permitted non-audit services by our independent registered public accounting firm only when it will be more effective or economical to have such services provided by our independent registered public accounting firm than by another firm. Our Audit Committee annually reviews and pre-approves the audit, audit-related, tax and other permissible non-audit services that can be provided by the independent registered public accounting firm. After the annual review, any proposed services exceeding pre-set levels or amounts, or additional services not previously approved requires separate pre-approval by our Audit Committee or the Chair of our Audit Committee. Any pre-approval decision made by the Chair of our Audit Committee is reported to our Audit Committee at the next regularly scheduled Audit Committee meeting. Our Chief Financial Officer and our Chief Accounting Officer can approve up to an additional $50,000 in the aggregate per calendar year for categories of services that our Audit Committee (or the Chair through its delegated authority) has pre-approved. All of the services provided by PwC during 2020 and 2019 were pre-approved in accordance with this policy. | | | | | | | | | 30 | |

| |  |

| | | | 6 | | Executive Compensation Matters |

| | | | | | | | | | | | Proposal 3 – Advisory Vote on Executive Compensation | | | | | | | |

Our Compensation Discussion and Analysis, which appears below, describes our executive compensation programs and the compensation decisions that our C&MD Committee and our Board of Directors made with respect to the 2020 compensation of our named executive officers. As required pursuant to Section 14A of the Exchange Act, our Board of Directors is asking that stockholders cast a non-binding, advisory vote FOR the following resolution: “RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.” Our Board of Directors is asking that our stockholders support this proposal. Although the vote you are being asked to cast is non-binding, we value the views of our stockholders, and our C&MD Committee and our Board of Directors will consider the outcome of the vote when making future compensation decisions for our named executive officers. As we describe in our Compensation Discussion and Analysis, our executive compensation programs embody a pay-for-performance philosophy that supports our business strategy and aligns the interests of our executives with those of our stockholders. In particular, our executive compensation programs reward financial, strategic and operational performance, and the goals set under our plans support our short- and long-range plans. In addition, to discourage excessive risk taking, we maintain policies for stock ownership, and our equity and annual bonus incentive plans have provisions providing for the recoupment of compensation. We also cap payments under our annual bonus plan, and we generally require multi-year vesting periods for long-term incentive awards. We will hold a non-binding, advisory vote of our stockholders on the compensation of our named executive officers every year until the next required stockholder vote on the frequency of such advisory vote. The next stockholder vote on the frequency of such advisory vote is expected to be held at the 2023 annual meeting of stockholders. OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE APPROVAL OF THE RESOLUTION SET FORTH ABOVE. | | | | | | | | | 31 | |

| |  |

| | | | 6 | | Executive Compensation Matters (continued) |

| COMPENSATION DISCUSSION AND ANALYSIS |

This Compensation Discussion and Analysis (CD&A) describes our compensation strategy, philosophy, policies and practices underlying our executive compensation programs for 2020. It also provides information regarding the compensation that was earned by and awarded to our 2020 named executive officers, whom we refer to collectively as “named executive officers” or “NEOs.” Our named executive officers include our current executive officers listed below as well as Jeffrey D. Capello*, our former Executive Vice President and Chief Financial Officer. | | | | | | | | | | | | |  | | | | Michel Vounatsos Chief Executive Officer | | | |  | | | | Susan H. Alexander Executive Vice President, Chief Legal Officer and Secretary | | | | | | | | | | | | | |  | | | | Michael R. McDonnell* Executive Vice President and Chief Financial Officer | | | |  | | | | Chirfi Guindo Executive Vice President, Global Product Strategy and Commercialization | | | | | | | | | | | | | |  | | | | Alfred W. Sandrock, Jr., M.D., Ph.D.** Executive Vice President, Research and Development | | | | | | | | |

| * | Mr. McDonnell was appointed as Executive Vice President and Chief Financial Officer effective August 15, 2020. Mr. Capello ceased to be our Executive Vice President and Chief Financial Officer on August 15, 2020, and separated from the Company on September 15, 2020. |

| ** | Dr. Sandrock was appointed as Executive Vice President, Research and Development on October 1, 2019. Prior to this appointment, Dr. Sandrock served as our Executive Vice President, Chief Medical Officer, and continued in this role, in addition to his duties as Executive Vice President, Research and Development, until January 27, 2020. |

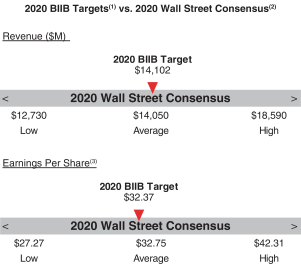

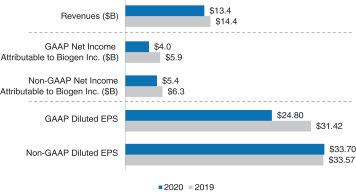

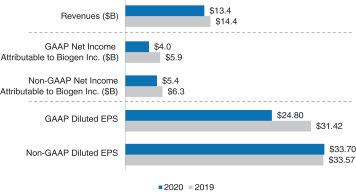

We had a productive and successful 2020 as we continued to execute well against our corporate strategy. Our full year revenue for 2020 was $13.4 billion, a 6% decrease from the prior year primarily due to the entry of multiple TECFIDERA generic entrants in the U.S. with deeply discounted prices compared to TECFIDERA. The generic competition for TECFIDERA significantly reduced our TECFIDERA revenues during the year ended December 31, 2020, and is expected to have a substantial negative impact on our TECFIDERA revenues for as long as there is generic competition. Excluding TECFIDERA in the U.S., our global MS revenue, including OCREVUS royalties, remained relatively stable for 2020, as compared to 2019, demonstrating the resilience of our MS business in a competitive market. We continued our launch of VUMERITY in the U.S., which was the number two MS product and the number one oral in terms of new prescriptions in the U.S. as of December 31, 2020. We maintained our leadership in our SMA business despite increased competition and delays in SPINRAZA doses due, directly or indirectly, to the COVID-19 pandemic. Although our full year 2020 SPINRAZA revenue decreased 2% as compared to 2019, we continued to see growth outside of the U.S., with full year 2020 revenue outside the U.S. growing 9% as compared to 2019, and we believe that SPINRAZA will remain a foundation of care in the treatment of SMA. | | | | | | | | | 32 | |

| |  |

| | | | 6 | | Executive Compensation Matters (continued) |

| COMPENSATION DISCUSSION AND ANALYSIS

|

This Compensation Discussion and Analysis (CD&A) describes our compensation strategy, philosophy, policies and practices underlying our executive compensation programs for 2018. It also provides information regarding the manner and context in which compensation was earned by and awarded to our 2018 named executive officers listed below, whom we refer to collectively as “named executive officers” or “NEOs.”

Our full year 2020 biosimilars revenue increased 8% as compared to 2019. Although our biosimilars business was negatively impacted by pricing pressure and a slowdown in new treatments and reduced clinic capacity due to the COVID-19 pandemic, we were the leading anti-TNF biosimilar provider in Europe in 2020, and BENEPALI was the #1 prescribed etanercept product across Europe. We also made significant progress toward building a multi-franchise portfolio, with 10 programs now in either Phase 3 or filed across a number of key therapeutic areas, including regulatory filings for aducanumab in the U.S., the E.U. and Japan. We added or advanced 12 clinical programs in Alzheimer’s disease, MS, ALS, Parkinson’s disease and other movement disorders, depression and biosimilars and had a strong year for business development, including multiple new strategic collaborations. We provided value to our stockholders through the return of approximately $6.7 billion in capital through share repurchases, and we continued our leading efforts in environmental, sustainability and diversity issues. To help ensure the health and safety of our employees, we took several actions in response to the ongoing COVID-19 pandemic. In the U.S. and in most other key markets, our office-based employees began working from home in early March 2020, while we ensured essential staffing levels in our operations remained in place, including maintaining key personnel in our laboratories and manufacturing facilities. To provide a safe work environment for our employees, we have, among other things, increased our cleaning and sanitation routines on our campuses, implemented various social distancing measures on our campuses, created electronic health attestation forms, issued travel advisories to our employees consistent with government regulations and restricted participation of our employees in any events that have large gatherings. We have also suspended the vast majority of our in-person interactions by our customer-facing professionals in healthcare settings and are engaging with these customers remotely as we seek to continue to support healthcare professionals and patient care. Our C&MD Committee considered all of these achievements, and challenges, as they navigated compensation decisions not just for our executive officers but for all of our employees. As described below, our C&MD Committee exercised its discretion and made adjustments to take into account items that were not originally contemplated, or whose magnitude or timing were uncertain, when the performance goals were originally established. Our C&MD Committee believed these adjustments were appropriate because the items were beyond the control of management, were not contemplated and/or could not be quantified due to uncertainty regarding magnitude and timing when the Company performance goals were originally set. Our C&MD Committee also believed that these adjustments were necessary to appropriately motivate and reward employees for their performance during a challenging year in which we continued to perform well despite the challenges that we faced. However, notwithstanding the attainment of our performance goals and the strength of management’s performance, our C&MD Committee also believed it was important to hold the members of our Executive Committee, which includes all of our NEOs, accountable for the Company’s overall financial results and business performance compared to the original performance goals. As a result, our C&MD Committee exercised its discretion and decreased the payouts under certain of our incentive compensation plans for the members of our Executive Committee, including all of our NEOs, as described below. Our C&MD Committee believes that our executive compensation program for 2020 is consistent with our compensation philosophies and principles described below and demonstrates our commitment to linking compensation to Company performance and strategy during a challenging year. | | | | | | | | | | | | |  | | | | Michel Vounatsos

Chief Executive Officer

| | | |  | | | | Susan H. Alexander

Executive Vice President,

Chief Legal Officer and Secretary

| | | | | | | | | | | | | |  | | | | Jeffrey D. Capello

Executive Vice President and

Chief Financial Officer

| | | |  | | | | Paul F. McKenzie, Ph.D.

Executive Vice President,

Pharmaceutical Operations & Technology

| | | | | | | | | | | | | |  | | | | Michael Ehlers, M.D., Ph.D.

Executive Vice President,

Research and Development

| | | | | | | | 33 | |

| |  |

| | | | 6 | | Executive Compensation Matters (continued) |

2018 Highlights

We had a productive and successful 2018. We generated record revenues of $13.5 billion for the year, demonstrated resilience in our MS business, continued a strong global launch for SPINRAZA, the first approved treatment for SMA, and made significant progress in our biosimilars business.

We added six clinical programs across our strategic core and emerging growth areas and had a strong year for business development.

We provided value to our stockholders through the return of approximately $4.4 billion in capital through share repurchases and we continued our leading efforts in environmental, sustainability and diversity matters.

Our executive compensation programs for 2018 were aligned with stockholder interests as compensation earned under these programs was closely-linked to the achievement of our corporate performance goals.

We achieved or exceeded the vast majority of the corporate performance goals that we set at the beginning of the year under our incentive compensation plans and, accordingly, the payouts under these plans for 2018 were above target payout levels.

| | | | | 31 | |  | |  |

2020 Highlights | | | 5 | | Executive Compensation Matters (continued)

|

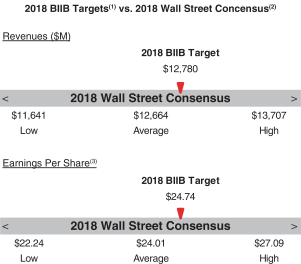

A brief summary of our 2018 business, financial and executive compensation highlights are as follows:

Financial Performance

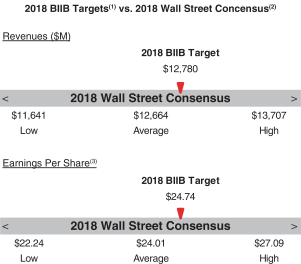

The following chart provides a summary of our financial performance for 2018 compared to 2017:

A reconciliation of our GAAP toNon-GAAP financial measures is provided in Appendix A to this Proxy Statement.

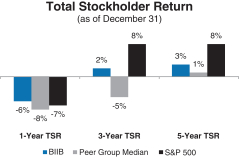

Total Stockholder Return

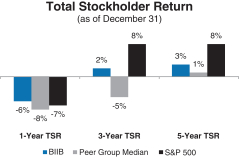

Ourone-, three- and five-year total stockholder return (TSR)* compared to our peer group and the Standard & Poor’s 500 (S&P 500) is set forth below.

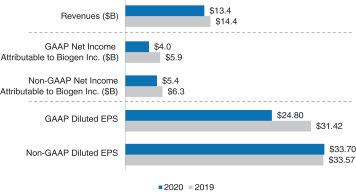

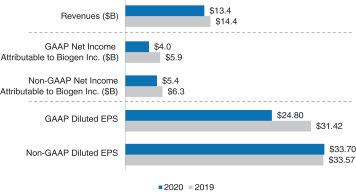

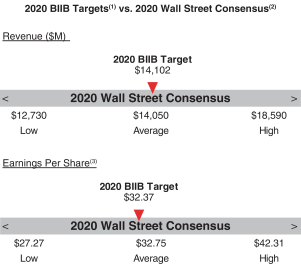

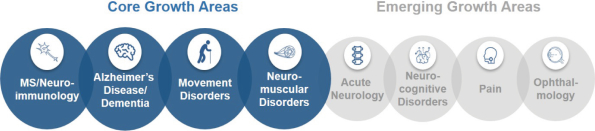

A brief summary of our 2020 business, financial and executive compensation highlights is as follows: Financial Performance The following chart provides a summary of our financial performance for 2020 compared to 2019: * | TSR is a measure of performance over time that combines changes in share price and dividends paid to show the total return to the stockholder expressed as an annualized percentage.

A reconciliation of our GAAP to Non-GAAP financial measures is provided in Appendix A to this Proxy Statement. Product and Pipeline Developments The following provides a summary of our product and pipeline developments for 2020: |

Product and Pipeline Developments

The following provides a summary of our product and pipeline developments for 2018:

Product Developments

In March 2018 we and AbbVie Inc. announced the voluntary worldwide withdrawal of ZINBRYTA for relapsing MS (RMS).

In October 2018 we and Samsung Bioepis launched IMRALDI, an adalimumab biosimilar referencing HUMIRA, in Europe.

Applications for Marketing and Agency Actions Aducanumab In July 2020 we completed the submission of a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for the approval of aducanumab. In August 2020 the FDA accepted the BLA and granted Priority Review with a Prescription Drug User Fee Act (PDUFA) action date on March 7, 2021. In January 2021 the FDA extended the review period for the BLA for aducanumab by three months. The updated PDUFA action date is June 7, 2021. In October 20182020 the FDA granted BIIB092, ananti-tau mAb, fast track designationEuropean Medicines Agency (EMA) accepted for progressive supranuclear palsy (PSP).review the Marketing Authorization Application (MAA) for aducanumab. In December 2018 Alkermes2020 the Ministry of Health, Labor and Welfare accepted for review the Japanese New Drug Application for aducanumab. SB11 (referencing LUCENTIS) In October 2020 the EMA accepted for review the MAA for SB11, a proposed ranibizumab biosimilar referencing LUCENTIS, and in November 2020 the FDA accepted the BLA for SB11. Ranibizumab is an anti-VEGF (vascular endothelial growth factor) for retinal vascular disorders, which are a leading cause of blindness. MS In March 2020 we made a regulatory submission to the EMA for a subcutaneous (SC) formulation of TYSABRI (natalizumab). In June 2020 we submitted a NDASupplemental Biologics License Application for a SC formulation of natalizumab to the FDAFDA. In October 2020 the first patient in the Phase 1 study of BIIB107 (anti-VLA4) in MS was dosed. In November 2020 we submitted a MAA for VUMERITY (diroximel fumarate; DRF) to the review of BIIB098 (diroximel fumarate). Alkermes is seeking approval of diroximel fumarate under the 505(b)(2) regulatory pathway. If approved, we intend to market diroximel fumarate under the brand name VUMERITY. This name has been conditionally accepted by the FDA and will be confirmed upon approval.EMA. | | | | | | | 32 | | 34 | |

| |  |

| | | 56 | | Executive Compensation Matters (continued) |

Clinical Trials

MS and Neuroimmunology

In September 2018 we completed enrollment of the Phase 2b AFFINITY study evaluating opicinumab, anti-LINGO, as anadd-on therapy in MS patients who are adequately controlled on their anti-inflammatory disease-modifying therapy (DMT), versus the DMT alone.

In November 2018 we initiated the Phase 3b NOVA study evaluating the efficacy and safety of extended interval dosing (every six weeks) for natalizumab compared to standard interval dosing in patients with RMS and enrolled the first patient in December 2018.

In December 2018 we dosed2020 the first patient inEuropean Commission approved a bioequivalence study to test whether exposure levelsnew intramuscular injection route of administration for PLEGRIDY are maintained with intramuscular administration.(peginterferon beta-1a) for the treatment of relapsing-remitting MS. Neuromuscular DisordersClinical Trials

• | | In September 2018 we enrolled the first patient in the Phase 1 study evaluating BIIB078(IONIS-C9Rx), an antisense oligonucleotide (ASO) drug candidate, in adults with C9ORF72-associated ALS.

|

• | | In December 2018 we and our collaboration partner Ionis Pharmaceuticals, Inc. (Ionis) announced results from a positive interim analysis of the ongoing Phase 1 study of BIIB067 (IONIS-SOD1Rx), an investigational treatment for ALS with superoxide dismutase 1 (SOD1) mutations. The interim analysis showed that, over a three-month period, BIIB067 resulted in a statistically significant lowering of SOD1 protein levels in the cerebrospinal fluid and a numerical trend towards slowing of clinical decline as measured by the ALS Functional Rating Scale Revised, both compared to placebo.

|

Alzheimer’s Disease and Dementia In May 2018 we initiatedMarch 2020 the first patient was dosed in the aducanumab re-dosing study, EMBARK, which is a Phase 2global re-dosing clinical study of BIIB092 fordesigned to evaluate aducanumab in eligible Alzheimer’s disease.disease patients who were actively enrolled in aducanumab studies (PRIME, EVOLVE, EMERGE and ENGAGE) in March 2019. In June 2018 we and our collaboration partner Eisai Co., Ltd. (Eisai) announced that elenbecestat,September 2020 the oral BACE (beta amyloid cleaving enzyme) inhibitor, demonstrated an acceptable safety and tolerability profilefirst patient was dosed in the Phase 2 study, and the results demonstrated a statistically significant difference in amyloid-beta levels in the brain measured by3 AHEAD amyloid-PET3-45 (positron emission tomography). A numerical slowing of decline in functional clinical scales of a potentially clinically important difference was also observed, although this effect was not statistically significant. In December 2017 we and our collaboration partner Eisai announced that the Phase 2 study of BAN2401 (lecanemab), an anti-amyloid beta antibody, in individuals with preclinical Alzheimer’s disease who have intermediate or elevated levels of amyloid in their brains. We are collaborating with Eisai on the development of BAN2401.

Neuromuscular Disorders In March 2020 the first patient was dosed in the global DEVOTE study, which is evaluating the safety, tolerability and potential for even greater efficacy of SPINRAZA when administered at a monoclonal antibody that targets amyloid beta aggregates, an Eisai product candidatehigher dose than currently approved for the treatment of Alzheimer’s disease, did not meet the criteria for success based on a Bayesian analysis at 12 months as the primary endpoint in an856-patient Phase 2 clinical study, an endpoint that was designed to enable a potentially more rapid entry into Phase 3 development. In July 2018, based upon the final analysis of the data at 18 months, we and Eisai announced that the topline results from the Phase 2 study demonstrated a statistically significant slowing in clinical decline and reduction of amyloid beta accumulated in the brain. The study achieved statistical significance on key predefined endpoints evaluating efficacy at 18 months on slowing progression in Alzheimer’s Disease Composite Score (ADCOMS) and on reduction of amyloid accumulated in the brain as measured usingamyloid-PET.SMA. In July 2018 we completed enrollmentSeptember 2020 the first patient in a Phase 1 study of ENGAGE and EMERGE, the Phase 3 studies of aducanumab. In March 2019 we and our collaboration partner Eisai announced that we were discontinuing the EMERGE and ENGAGE Phase 3 studies.BIIB105 (ataxin-2 ASO), an antisense oligonucleotide (ASO) targeting ataxin-2 in ALS, was dosed. Movement Disorders In January 2018 we dosedJuly 2020 the first patient in the Phase 2 SPARK1 study of BIIB054,a-synuclein antibody,BIIB101 (ION464), an ASO targeting alpha synuclein in Parkinson’s disease. In September 2018 we completed enrollment of the Phase 2 PASSPORT study of BIIB092 for PSP.multiple system atrophy, was dosed.

Acute NeurologyImmunology

In March 2018 we dosedAugust 2020 the first patient in the Phase 2 OPUS study of natalizumab in drug-resistant focal epilepsy. In September 2018 we enrolled the first patientwas dosed in the Phase 3 CHARM studyprogram for dapirolizumab pegol (anti-CD40L) in patients with active systemic lupus erythematosus despite being treated by standard of BIIB093, glibenclamide IV,care therapies. Dapirolizumab pegol is being developed in large hemispheric infarction, a severe form of ischemic stroke.collaboration with UCB Pharma S.A.

| | | | | 33 | |  | |  |

| | | 5 | | Executive Compensation Matters (continued)

|

Neurocognitive DisordersBiosimilars – Samsung Bioepis – Biogen’s Joint Venture with Samsung BioLogics

In December 2018 we dosedMay 2020 Samsung Bioepis announced that the first patientprimary endpoints were met in ourthe randomized, double-masked, Phase 2b study3 trial comparing the efficacy, safety and immunogenicity of BIIB104 (AMPA) in CIAS.SB11 to the reference product (LUCENTIS). Pain

In March 2018 weJune 2020 Samsung Bioepis initiated a Phase 13 study of BIIB095,for SB15, a Nav 1.7 inhibitor for neuropathic pain. In May 2018 we initiated a Phase 2 study of vixotrigine (BIIB074)proposed aflibercept biosimilar referencing EYLEA. EYLEA is widely used to treat ophthalmologic conditions such as neovascular (wet) age-related macular degeneration, macular edema following retinal vein occlusion, diabetic macular edema (DME) and diabetic retinopathy in small fiber neuropathy.

Other

In September 2018 we dosed the first patient in the Phase 2b study of BG00011(STX-100) in idiopathic pulmonary fibrosis, a chronic irreversible and ultimately fatal disease characterized by a progressive decline in lung function.patients with DME.

Discontinued Programs In February 2018March 2020 we announced that the Phase 2b dose-ranging ACTION2 OPUS study investigating natalizumab as an adjunctive therapy in individualsadults with acute ischemic stroke (AIS)drug-resistant focal epilepsy did not meet its primary endpoint. Safety data were in-line with the known safety profile of natalizumab. Based on these results, we discontinued development of natalizumab in AIS. The results of the Phase 2b ACTION study do not impact the benefit-risk profile of natalizumab in approved indications, including MS.drug-resistant focal epilepsy. In October 20182020 we announced that we completed the Phase 2b2 AFFINITY study of vixotrigine (BIIB074) for the treatment of painful lumbosacral radiculopathy (PLSR). The studyopicinumab (anti-LINGO) in MS did not meet its primary or secondary efficacy endpoints andendpoints. Based on these results, we discontinued development of vixotrigine for the treatment of PLSR. The safety data were consistent with the safety profile reported in previous studies.opicinumab. Business Development In January 2018March 2020 we acquired BIIB100 from Karyopharm Therapeutics Inc. BIIB100 isBIIB118 (CK1 inhibitor), a Phasenovel CNS-penetrant small molecule inhibitor of casein kinase 1, ready investigational oral compound for the potential treatment of certainpatients with behavioral and neurological symptoms across various psychiatric and neurodegenerativeneurological diseases primarily in ALS. BIIB100 is a novel therapeutic candidate that works by inhibiting a protein known as XP01, with the goal of reducing inflammation and neurotoxicity, along with increasing neuroprotective responses. In April 2018 we acquired BIIB104 from Pfizer Inc. BIIB104 is afirst-in-class, Phase 2b ready AMPA receptor potentiatorWe are developing BIIB118 for CIAS, representing our first programthe potential treatment of irregular sleep wake rhythm disorder in neurocognitive disorders. AMPA receptors mediate fast excitatory synaptic transmission in the central nervous system, a process which can be disrupted in a number of neurologicalParkinson’s disease and psychiatric diseases, including schizophrenia.

In June 2018 we closed a10-year exclusive agreement with Ionisplan to develop novel ASO drug candidates for a broad range of neurological diseases (the 2018 Ionis Agreement). We have the option to license therapies arising out of the 2018 Ionis Agreement and will be responsibleBIIB118 for the development and potential commercialization of such therapies.

In June 2018 we entered into an exclusive option agreement with TMS Co., Ltd. granting us the option to acquireTMS-007, a plasminogen activator with a novel mechanism of action associated with breaking down blood clots, which is in Phase 2 development in Japan, and backup compounds for the treatment of stroke.

In June 2018 we exercised our option under our joint venture agreement with Samsung BioLogics to increase our ownership percentagesundowning in Samsung Bioepis from approximately 5% to approximately 49.9%. The share purchase transaction was completed in November 2018.

In July 2018 we acquired BIIB110 (Phase 1a) andALG-802 (preclinical) from AliveGen Inc. BIIB110 andALG-802 represent novel ways of targeting the myostatin pathway. We initially plan to study BIIB110 in multiple neuromuscular indications, including SMA and ALS.

In December 2018 we exercised our option with Ionis and obtained a worldwide, exclusive, royalty-bearing license to develop and commercialize BIIB067, an investigational treatment for ALS with SOD1 mutations.

In December 2018 we entered into a collaborative research and license agreement with C4 Therapeutics (C4T) to investigate the use of C4T’s novel protein degradation platform to discover and develop potential new treatments for neurological diseases, such as Alzheimer’s disease and Parkinson’s disease. We will be responsible for the development and potential commercialization of any therapies resulting from this collaboration.

| | | | | | | 34 | | 35 | |

| |  |

| | | 56 | | Executive Compensation Matters (continued) |

In April 2020 we closed a collaboration and license agreement with Sangamo to develop and commercialize ST-501 for tauopathies, including Alzheimer’s disease; ST-502 for synucleinopathies, including Parkinson’s disease; a third neuromuscular disease target; and up to nine additional neurological disease targets to be identified and selected within a five-year period. The companies are leveraging Sangamo’s proprietary zinc finger protein technology delivered via adeno-associated virus to modulate the expression of key genes involved in neurological diseases. In October 2020 we closed a collaboration and license agreement with Denali to co-develop and co-commercialize Denali’s small molecule inhibitors of leucine-rich repeat kinase 2 (LRRK2) for Parkinson’s disease. In addition to the LRRK2 program, we also have an exclusive option to license two preclinical programs from Denali’s Transport Vehicle platform, including its Antibody Transport Vehicle (ATV): ATV enabled anti-amyloid beta program and a second program utilizing its Transport Vehicle technology. Further, we have a right of first negotiation on two additional Transport Vehicle-enabled therapeutics, should Denali decide to seek a collaboration for such programs. In December 2020 we closed a global collaboration and license agreement with Sage to jointly develop and commercialize BIIB125 (zuranolone) for the potential treatment of major depressive disorder and postpartum depression and BIIB124 (SAGE-324) for the potential treatment of essential tremor with potential in other neurological conditions such as epilepsy. Share Repurchase Activity In August 2018October 2020 our Board of Directors authorized a program to repurchase up to $3.5$5.0 billion of our common stock (2018(2020 Share Repurchase Program). Our 20182020 Share Repurchase Program does not have an expiration date. All share repurchases under our 20182020 Share Repurchase Program will be retired. We returned approximately $4.4$6.7 billion to stockholders in 20182020 through share repurchases under our 20182020 Share Repurchase Program, and our 2016March 2019 Share Repurchase Program, which was a program authorized by our Board of Directors in July 2016March 2019 to repurchase up to $5.0 billion of our common stock and whichthat was completed as of JuneMarch 31, 2020, and our December 2019 Share Repurchase Program, which was a program authorized by our Board of Directors in December 2019 to repurchase up to $5.0 billion of our common stock that was completed as of September 30, 2018.2020. Other Notable Achievements in the Workplace and Community | • | | In September 2020 we announced Healthy Climate, Healthy Lives, a $250.0 million, 20-year initiative to eliminate fossil fuels across our operations and collaborate with renowned institutions with the aim to improve health, especially for the world’s most vulnerable populations. We are the first Fortune 500 company to commit to become fossil fuel free across our operations by 2040. |

Awarded the 2018 International Prix Galien as Best Biotechnology Product for SPINRAZA. The prestigious honor marks the seventh Prix Galien for SPINRAZA, following country recognitionsapproximately €2.4 billion of healthcare savings in the U.S., Germany, Italy, Belgium-Luxembourg, the Netherlands and the U.K. The International Prix Galien is given every two years2020 across Europe that we estimate was contributed by Prix Galien International Committee members in recognition of excellence in scientific innovation to improve human health.our three anti-TNF biosimilars.

Named the Biotechnology Industry Leadernumber one biotechnology company on the Dow Jones Sustainability World Index.Index for the fifth time. Launched our electric vehicle fleet program, expanding our battery electric vehicles to 12 and office chargers to 49 as of December 31, 2020. Recognized as a corporate sustainability leader with the Gold Class and Industry Mover Sustainability AwardsAward from RobecoSAM. Continued commitmentUsed green chemistry processes and techniques to operational carbon neutrality highlighted through the use of 100% renewable electricity globally.reduce our waste and energy consumption.

Committed to reduce carbon emissions by a targeted amount approved byclimate target consistent with reductions required to keep warming to 1.5°C and joined the Science Based Target Initiative,Business Ambition to align ourselves with the global goal of limiting global temperature rise to under two degrees Celsius.1.5°C. Earned CDP scores of A,A-Began engaging our employees and Bsuppliers in the areas of Supplier Engagement, Climate Changetransition to a fossil fuel-free future with 100% renewable electricity targets for suppliers and Water, respectively.sustainable benefit programs for employees.

Earned a perfect score of 100% on the Human Rights Campaign’s Corporate Equality Index (a national benchmarking tool on corporate policies and practices pertinent to LGBTQ employees) for the fifthseventh consecutive year and a perfect score of 100% on the Disability Equality Index for the third consecutive year. Continued our commitment to diversity, equity and inclusion. As of December 31, 2018, 44%2020, 48% of Director-leveldirector-level positions and above were held by women.women, and, in the U.S., 28% were held by ethnic or racial minorities. Over 3,200 employees volunteered from 28 countries during our annual Care Deeply Day.Launched an enhanced strategy with the aim to boost diversity* in U.S. manager positions and above by 30% by the end of 2021.

Engaged 50,000+more than 57,000 students inhands-on learning to inspire their passion for science since the inception of Biogen’s Community Labs.Labs in 2002 with priority focus on underrepresented students. | | | | | | | | | 36 | |

| |  |

| | | | 6 | | Executive Compensation Matters (continued) |

| * | Percent of U.S. manager positions and above held by Black, African American and Latinx employees as well as Asian employees where underrepresented. |

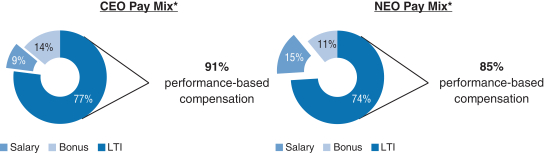

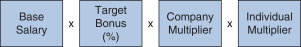

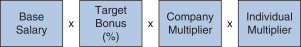

20182020 Executive Compensation Programs andPay-for-Performance Alignment

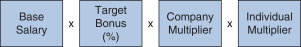

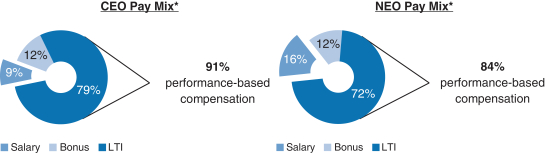

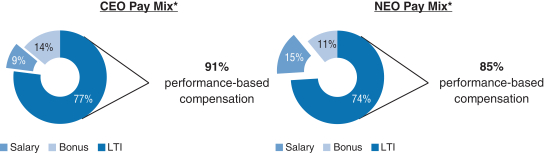

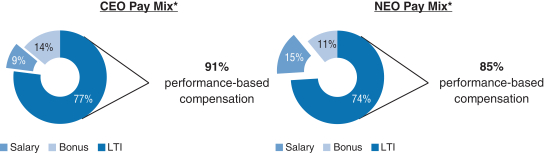

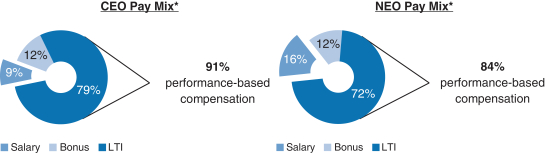

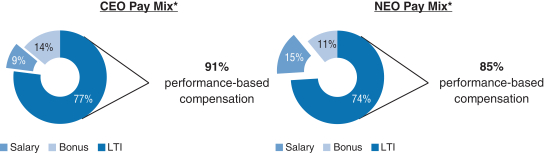

We believe our executive compensation programs are effectively designed and have worked well to implement apay-for-performance culture that is aligned with the interests of our stockholders. In 20182020 our executive compensation programs consisted of base salary, short- and long-term incentives and other benefits. 91% of our CEO’s and 84%85% of our other currently-employed NEOs’ 2018(other than our CEO) 2020 target compensation was performance-based andat-risk.

| | * | Reflects annual salary, target bonus and target grant value of the 20182020 annual long-term incentive awards. The NEO compensation mix excludes theone-time sign-on transitionbonus paid to Mr. McDonnell in connection with his hire, as described in further detail below, as well as compensation for Mr. Capello due to his partial year employment with Biogen in 2020. |

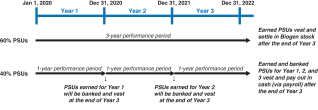

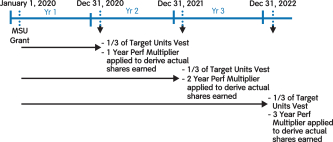

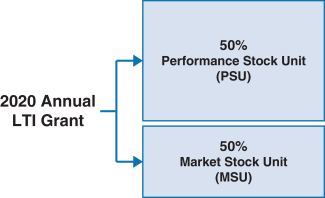

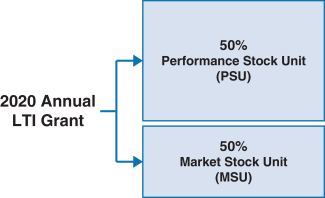

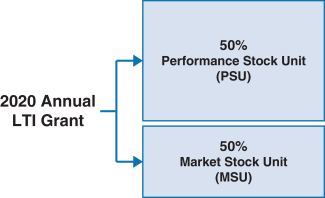

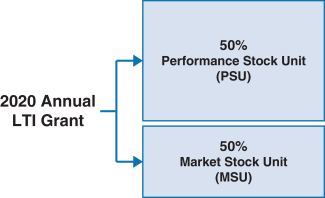

100% of our NEOs’ 2020 annual long-term incentive (LTI) grants were performance-based and at-risk* | | |

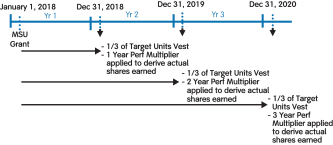

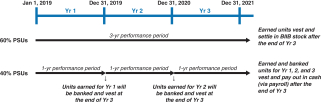

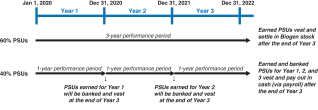

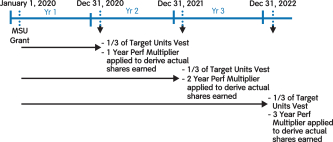

| | • 60% earned based on achievement of three-year pipeline milestone performance goals • 40% earned based on achievement of three one-year financial goals relating to Non-GAAP adjusted free cash flow and revenue • Earned based on stock price performance over one-, two- and three-year periods |

| * | Does not include sign-on LTI awards of RSUs granted to Dr. Ehlers, Ms. Alexander and Dr. McKenzie,Mr. McDonnell in connection with his hire in August 2020. |

Our 2020 performance-based compensation payouts align with our commitment to strong performance and accountability. Our executive compensation program is structured to closely align with our business purpose and commitment to drive the creation of long-term stockholder value. Our C&MD Committee considered our achievements in 2020 as well as the challenges we faced and made adjustments to certain of the performance goals in our incentive compensation plans to take into account items that were not originally contemplated, or whose magnitude or timing were uncertain, when the performance goals were originally established. At the same time, our C&MD Committee believed it was important to hold the members of our Executive Committee, which includes all of our NEOs, accountable for the Company’s overall financial results and business performance compared to the original performance goals and decreased the payouts under certain of our incentive plans for our NEOs. As a result, the payouts for our NEOs, as a percentage of target, for our 2020 annual bonus plan and the portions of our PSUs and our MSUs that were eligible to be earned based on 2020 performance were below target payout amounts, as described in further detail below. |

| | | | | | | 35 | | 37 | |

| |  |

| | | 56 | | Executive Compensation Matters (continued) |

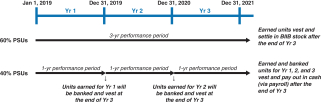

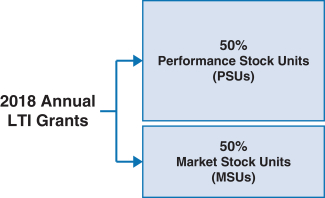

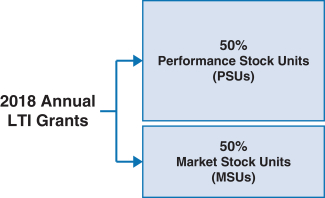

100% ofWe believe that our NEOs’ 2018 annual long-term incentive (LTI) grants were performance-based andat-risk.

| | |  | | • 60% earned based on achievement of three-year adjustedNon-GAAP diluted earnings per share (EPS) and pipeline milestone performance goals

• 40% earned based on achievement of adjustedNon-GAAP free cash flows and revenues over threeone-year performance periods

• PSUs were introduced in 2018. For more information on our PSUs, please see “Long-Term Incentives – 2018 PSUs” below.

• Earned based on stock price performance over one, two and three year periods

|

Our 2018 performance-based2020 executive compensation payouts align withprogram, including the adjustments made by our C&MD Committee, demonstrates our commitment to strong performance.

In 2018 we exceeded the vast majority of the corporatelinking compensation to Company performance goals that we set at the beginning of theand strategy during a challenging year forwhile holding our incentive compensation plans. As a result, the payouts, as a percentage of target, for our 2018 annual bonus plan and the portions of our PSUs and MSUs that were eligible to be earned based on 2018 performance were above target payout amounts, as described in further detail below.executive officers accountable.

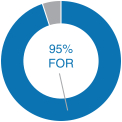

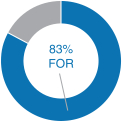

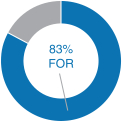

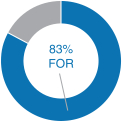

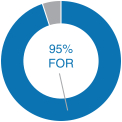

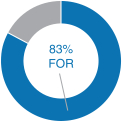

20182020 Advisory Vote on Executive Compensation

| | | At our 20182020 annual meeting of stockholders, we continued to receive strong support for our executive compensation programs with approximately 95%83% of the votes cast for approval of our annual“say-on-pay” proposal. Our C&MD Committee viewed this as positive support for our executive compensation programs and their alignment with long-term stockholder value creation and determined that the Company’s executive compensation programs have been effective in implementing the Company’s stated compensation philosophy and objectives. | |

| Our C&MD Committee is committed to continually reviewing our executive compensation programs on a proactive basis to ensure the ongoing alignment of such programs with the interests of our stockholders. | |  | |

In 20182020 our C&MD Committee reviewed the external landscape,our executive compensation programs in light of market data, the results from our“say-on-pay” proposal at last year’s annual meeting of stockholders and the Company’s performance against the current compensation programs.performance. Our C&MD Committee was satisfied that our existing executive compensation programs further ourpay-for-performance philosophy but made certain enhancementsand, accordingly, did not recommend any significant changes to the design of our LTI program in 2018 to strengthen its focus on long-term performance and alignment with our stockholders’ interests.executive compensation programs for 2020. |

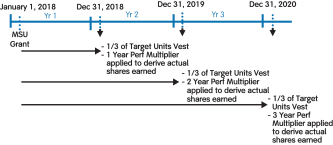

Specifically, under our 2018 LTI program, grants of PSUs replaced grants of cash-settled performance units (CSPUs), which we had granted in previous years. The key changes are as follows:

PSU awards are subject to three-year cliff vesting as compared to annual ratable vesting over three years (1/3 per year) for CSPU awards;

60% of PSU awards are earned over a three-year performance period based on the achievement of three-year cumulative performance goals for stock-settled PSU awards and 40% of PSU awards are earned over three annual performance periods based on the achievement of three sets of annual performance goals for cash-settled PSU awards as compared to 100% of CSPUs awards earned based upon one annual performance period for CSPU awards; and

60% of the PSU awards will be settled in stock and 40% of the PSU awards will be settled in cash as compared to 100% cash settlement for CSPU awards.

| | | | | 36 | |  | |  |

| | | 5 | | Executive Compensation Matters (continued)

|

For additional information on our PSU awards, please see “Long-Term Incentives – 2018 PSUs” below.

Roles and Responsibilities Role of our C&MD Committee Our C&MD Committee, which is composed of fourthree independent directors, oversees and administers our executive compensation programs. In making executive compensation decisions, our C&MD Committee reviews a variety of factors and data, most importantly our performance and individual executives’executive performance, and considers the totality of compensation that may be paid.paid or the value of which that may be granted. In addition, our C&MD Committee administers our annual bonus plan and our equity plans, reviews business achievements relevant to payouts under our compensation plans, makes recommendations to our Board of Directors with respect to compensation policies and practices as well as the compensation of our CEO and seeks to ensure that total compensation paid to our executive officers is fair, competitive and aligned with stockholder interests. Our C&MD Committee retains the right to hire outside advisors as needed to assist it in reviewing and revising our executive compensation programs. The duties and responsibilities of our C&MD Committee are described on page 2019 and can be found in our C&MD Committee’s written charter adopted by our Board of Directors, which can be found on our website,www.biogen.com, under the “Corporate Governance” subsection of the “Investors” section of the website. RoleMichel Vounatsos

| | | | 53,072 | | | | | — | | | | | 53,072 | | | | | * | | Michael R. McDonnell | | | | — | | | | | — | | | | | — | | | | | — | | Alfred W. Sandrock, Jr. | | | | 17,841 | | | | | — | | | | | 17,841 | | | | | * | | Susan H. Alexander | | | | 41,576 | | | | | — | | | | | 41,576 | | | | | * | | Chirfi Guindo | | | | 6,006 | | | | | — | | | | | 6,006 | | | | | * | | Jeffrey D. Capello(7) | | | | 3,118 | | | | | — | | | | | 3,118 | | | | | * | | Directors | | | | | | | | | | | | | | | | | | | | | Alexander J. Denner(8) | | | | 655,064 | | | | | 890 | | | | | 655,954 | | | | | * | | Caroline D. Dorsa | | | | 20,207 | | | | | 890 | | | | | 21,097 | | | | | * | | Maria C. Freire | | | | — | | | | | — | | | | | — | | | | | — | | William A. Hawkins | | | | 1,115 | | | | | 890 | | | | | 2,045 | | | | | * | | William D. Jones | | | | — | | | | | — | | | | | — | | | | | — | | Nancy L. Leaming | | | | 12,098 | | | | | 890 | | | | | 12,988 | | | | | * | | Jesus B. Mantas | | | | 2,053 | | | | | 890 | | | | | 2,943 | | | | | * | | Richard C. Mulligan | | | | 12,064 | | | | | 890 | | | | | 12,954 | | | | | * | | Robert W. Pangia(9) | | | | 19,742 | | | | | 890 | | | | | 20,632 | | | | | * | | Stelios Papadopoulos(10) | | | | 33,301 | | | | | 1,470 | | | | | 34,771 | | | | | * | | Brian S. Posner | | | | 6,870 | | | | | 890 | | | | | 7,760 | | | | | * | | Eric K. Rowinsky | | | | 16,179 | | | | | 890 | | | | | 17,069 | | | | | * | | Stephen A. Sherwin | | | | 15,438 | | | | | 890 | | | | | 16,328 | | | | | * | | Executive officers and directors as a group (21 persons)(11) | | | | 926,695 | | | | | 10,370 | | | | | 937,065 | | | | | * | |

| * | Represents beneficial ownership of less than 1% of our outstanding shares of common stock. |

| | | | | | | | | 26 | |

| |  |

| | | | 4 | | Stock Ownership (continued) |

| (1) | The shares described as “owned” are shares of our common stock directly or indirectly owned by each listed person, rounded up to the nearest whole share. |

| (2) | Includes RSUs that will vest within 60 days of the Independent Compensation ConsultantOwnership Date. |

| (3) | Our C&MD Committee believes that independent adviceThe calculation of percentages is important in developing and overseeing our executive compensation programs. Frederic W. Cook & Co., Inc. (FW Cook) served as our C&MD Committee’s independent compensation consultant until June 2018 and advised our C&MD Committee regarding compensation decisions in 2018. FW Cook did not provide any other services to Biogen. Pearl Meyer & Partners LLC (Pearl Meyer) has served as our C&MD Committee’s independent compensation consultant since June 2018 and has advised our C&MD Committee regarding compensation decisions since that time. Pearl Meyer does not provide any other services to Biogen and engages in other matters as needed and as directed solely by our C&MD Committee. References in this CD&A to our independent compensation consultant refer to FW Cookbased upon 150,554,556 shares outstanding on the Ownership Date, plus for the period during which it was engaged and to Pearl Meyer thereafter.

Reporting directly to our C&MD Committee, our independent compensation consultant provides guidance on trends in CEO, executive andnon-employee director compensation, the development of specific executive compensation programs and the compositioneach of the Company’s compensation peer group. Additionally,individuals listed above the shares subject to RSUs exercisable within 60 days of the Ownership Date, as reflected in the column under the heading “Shares Subject to Options and Stock Units.”

|

| (4) | Based solely on information as of December 31, 2020, contained in a Schedule 13G/A filed with the SEC by PRIMECAP Management Company on February 12, 2021, which also indicates that it has sole voting power over 15,443,182 shares and sole dispositive power over 15,822,066 shares. |

| (5) | Based solely on information as of December 31, 2020, contained in a Schedule 13G/A filed with the SEC by BlackRock, Inc. on January 29, 2021, which also indicates that it has sole voting power with respect to 11,672,922 shares and sole dispositive power with respect to 13,419,601 shares. |

| (6) | Based solely on information as of December 31, 2020, contained in a Schedule 13G/A filed with the SEC by The Vanguard Group on February 10, 2021, which also indicates that it has sole dispositive power with respect to 11,213,323 shares, shared voting power with respect to 259,934 shares and shared dispositive power with respect to 638,187 shares. |

| (7) | Mr. Capello ceased to be our independent compensation consultant preparesExecutive Vice President and Chief Financial Officer on August 15, 2020, and separated from the Company on September 15, 2020. |

| (8) | Includes 643,000 shares beneficially owned by funds and accounts managed by Sarissa Capital Management LP, a report on CEO payDelaware limited partnership (Sarissa Capital). Dr. Denner is the Chief Investment Officer of Sarissa Capital and ultimately controls the funds and accounts managed by Sarissa Capital. By virtue of the foregoing, Dr. Denner may be deemed to indirectly beneficially own (as that compares each elementterm is defined in Rule 13d-3 of compensationthe Exchange Act) the 643,000 shares that those entities beneficially own. Dr. Denner disclaims beneficial ownership of these shares except to thatthe extent of CEOs in comparable positions at companies in our peer group. Using this and other similar information, our C&MD Committee recommends, andany pecuniary interest therein. |

| (9) | Includes 16,000 shares beneficially owned by Robin Drive, LLC, of which Mr. Pangia’s wife is the Trustee. Mr. Pangia is retiring from our Board of Directors, approves, the elements and target levels of our CEO’s compensation. During 2018 the Company paid FW Cook and Pearl Meyer $123,275 and $47,666, respectively, in consulting fees directly related to these services. Our C&MD Committee assessed FW Cook’s independence annually and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2017 that FW Cook’s work did not raise any conflicts of interest and that FW Cook remained independent under applicable rules. Our C&MD Committee assessed Pearl Meyer’s independence in connection with its engagement in June 2018 and, in accordance with applicable SEC and Nasdaq rules, confirmed in December 2018 that Pearl Meyer’s work did not raise any conflicts of interest and that Pearl Meyer remains independent under applicable rules.

Role of our CEO

Each year our CEO provides an assessmenteffective as of the performanceAnnual Meeting.

|

| (10) | Includes 28,206 shares held in limited liability companies of each executive officer, other than himself, duringwhich Dr. Papadopoulos is the prior year and recommends to our C&MD Committee the compensation to be paidsole manager. |

| (11) | Includes 688,175 shares held indirectly through trusts, funds, defined benefit plans or awarded to each executive. Our CEO’s recommendations are based on numerous factors, including:limited liability companies. |

Company, team and individual performance;

potential for future contributions;

leadership competencies;

external market competitiveness;

internal pay comparisons; and

other factors deemed relevant.

| | | | | | | | | To understand the external market competitiveness of the compensation for our executive officers, our CEO and our C&MD Committee review a report analyzing publicly-available information and surveys prepared by our internal27

| |

| | | | | 37 | |  | |  |

| | | | | | | Proposal 2 – Ratification of the Selection of Our Independent Registered Public Accounting Firm | | | | | | | |